Digital Payment, as a sector, has evolved in leaps and bounds with technology revolutionizing modes of payment. The frictionless payment and contactless payment are two most commonly used terms in the FinTech industry. The covid-19 pandemic accelerated the growth and innovation in developing secure and efficient systems that facilitate contactless payment. Physical currency such as cash and coins, payment modes that require physical entities such as cards and cheques are nearing obsolescence.

The rapid advancement in digital payment with innovative features facilitates secure, swift, and hassle-free payment experience. Contactless payment is the subsequent step of progress that requires extensive integration to the existing payment systems to offer improved speed and convenience for end-users. Here is a quick read about how contactless payments work and the different contactless payment modes currently available in the marketplace.

Contactless Card Payment

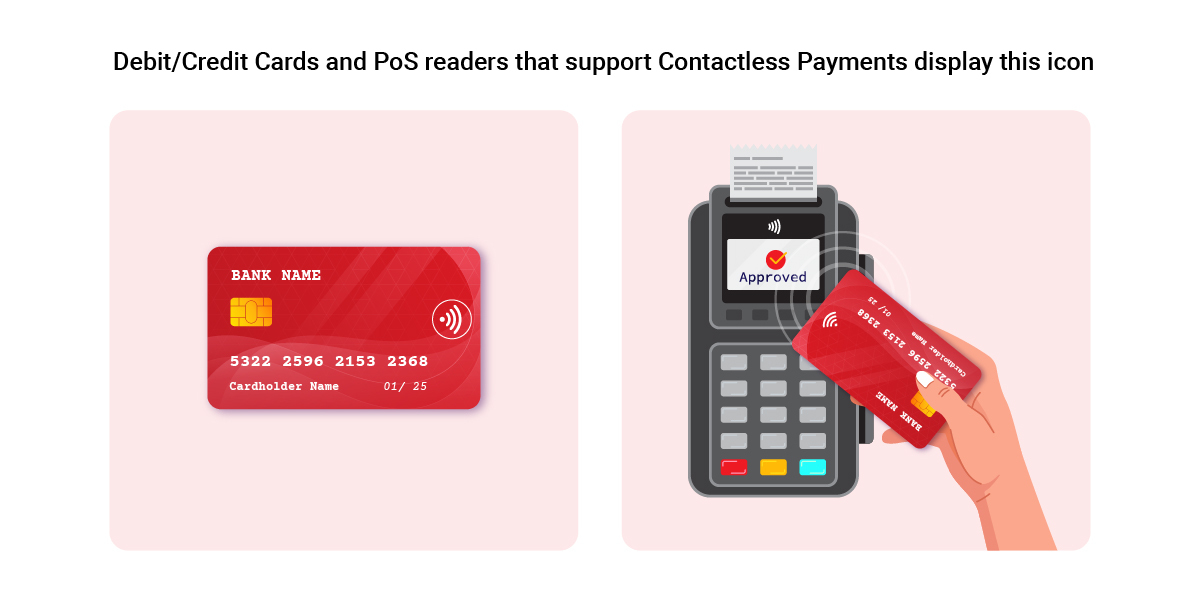

We no longer need to hand in our Debit and Credit Cards to make a payment. We do not even need to swipe it in the PoS (Point of Sale) terminal. All we need to do is tap or wave the card to make a payment. The tap & go debit and credit cards are offered by card providers such as Visa, MasterCard, and more.

The contactless card payment uses RFID technology to process the digital payment. This technology incorporated in both cards and the card reader uses radio waves to collect data and enter them directly into the system with little or no human intervention. The RFID chip in the debit/credit card is not powered and relies on the powered contactless PoS reader to use the generated Radio Frequency (RF) to enable contactless payment.

UPI Payment

Unified Payments Interface is an immediate real-time payment system that helps instantly transfer funds through a mobile platform. It allows multiple bank accounts to use the platform without the need for customers to enter bank details or other sensitive information. Developed by NPCI (National Payments Corporation of India) and regulated by RBI (Reserve Bank of India), the UPI enables secure peer-to-peer inter-bank transfers through a simple two-click authentication process.

The underlying technology used by UPI is IMPS (Immediate Payment Service), which is one of the popular modes of transaction available with internet banking. The backend of UPI system is built on top of IMPS and all transactions are processed using IMPS system only. But unlike an IMPS user who needs to enter bank account details and IFSC code of the receiver, the UPI system only requires the UPI ID to make a payment.

e-Wallets

Digital wallets or mobile wallets or e-wallets are online payment tools that securely store debit and credit card information, so you can avoid carrying a physical plastic card with you. In the form of a mobile application, e-wallets can be used to pay using smartphone, tablet, smart watch, or other compatible wearables. Most banks and some private entities offer digital wallet services.

The digital wallets use NFC (Near Field Communication) technology to transfer data when devices are in close proximity (generally an inch-and-a-half), QR (Quick Response) codes to process contactless digital payment. Some digital wallets generate an MST (Magnetic Secure Transmission) to communicate with PoS readers that required cards to be swiped and are not equipped with new upgrades for contactless payment.

Advantages of Contactless Payment- Customer’s perspective

- Clean and Hygienic

- Swift and Smooth Payment Process

- Increased convenience for both customer and merchant

- Easier payment modes improve efficiency and customer loyalty

- Customers are not expected to carry cards or enter sensitive information

like PIN numbers at the PoS terminal

Advantages of Contactless Payment- Merchant’s Perspective

- Easily accessible

- Requires minimal support

- Not limited by Banking hours

- Speedy Payment services reduce long queues and improves

purchase experience for the customer. - Hassle-free, quick, and efficient payment mode for

micro-businesses and small businesses.

Contactless Payments are the future of Digital Payments. Understanding the innovative technology that facilitates the swift and smooth payment process is important for both customer and the vendor. Know more about Pay10 and the diverse number of FinTech services that facilitates contactless payments and security features that powers an analytical dashboard that facilitates all your business needs; Payment Links, Payout services, Billing service, Reseller services, and more.